How I improved my crypto trading bot’s exit strategy

This is a milestone that I’m quite proud of and I’m excited to share this with you all.

I’ve been working on an algo trading platform alongside a small team of developers for about 3 years now. Between us we’ve put together the foundation for what we believe to be the future of investment and wealth management.

It’s a big vision and there’s a lot of work ahead of us, but we’ve recently pushed an update that gives users a lot more control over their exit strategy.

An exit strategy is how and when you’re planning to exit the market. An exit strategy should limit your losses and be able to cash out at a profit — hence the good old Stop Loss and Take Profit. These are invaluable, but pretty basic.

We wanted to give people more control over when assets are being sold in order to keep the liquidity moving and re-allocate to new opportunities.

Most traders have some sort of plan. A Stop Loss, a Take Profit, or a Trailing Stop. But what happens when the market doesn’t move according to your plan? Or even worse, doesn’t move at all?

All that juicy liquidity is now stuck in an asset that just won’t move. The issue becomes even more relevant when you consider algorithmic trading. That is — using trading bots that work on a pre-defined series of rules in order to manage your portfolio.

Unless the bot has an infinite budget, in which case you probably don’t need to bother reading this article, a good strategy ensures that the bot has consistent liquidity available to keep opening new positions. That means, closing old positions, ideally at a profit, and freeing up liquidity to continue executing the same strategy consistently.

Here is our solution to managing bot liquidity:

Stale Asset Selloff

The first feature we’ve added is simply called Stale Asset Selloff. It allows you select a time limit that when reached, the trading bot will automatically sell stale assets.

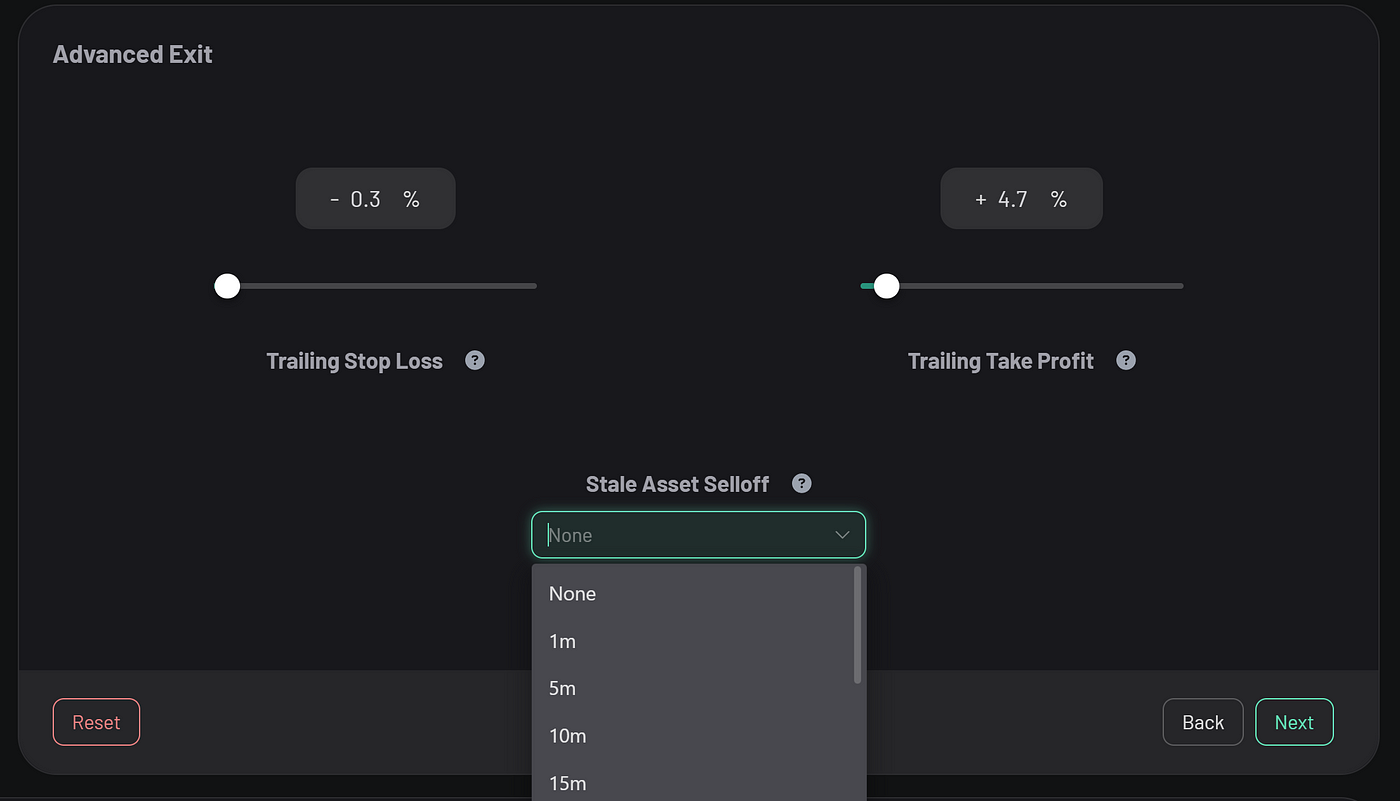

We’ve added the stale asset selloff to the Advanced Exit, meaning that it will work in combination with your Trailing Stop Loss and Trailing Take Profit.

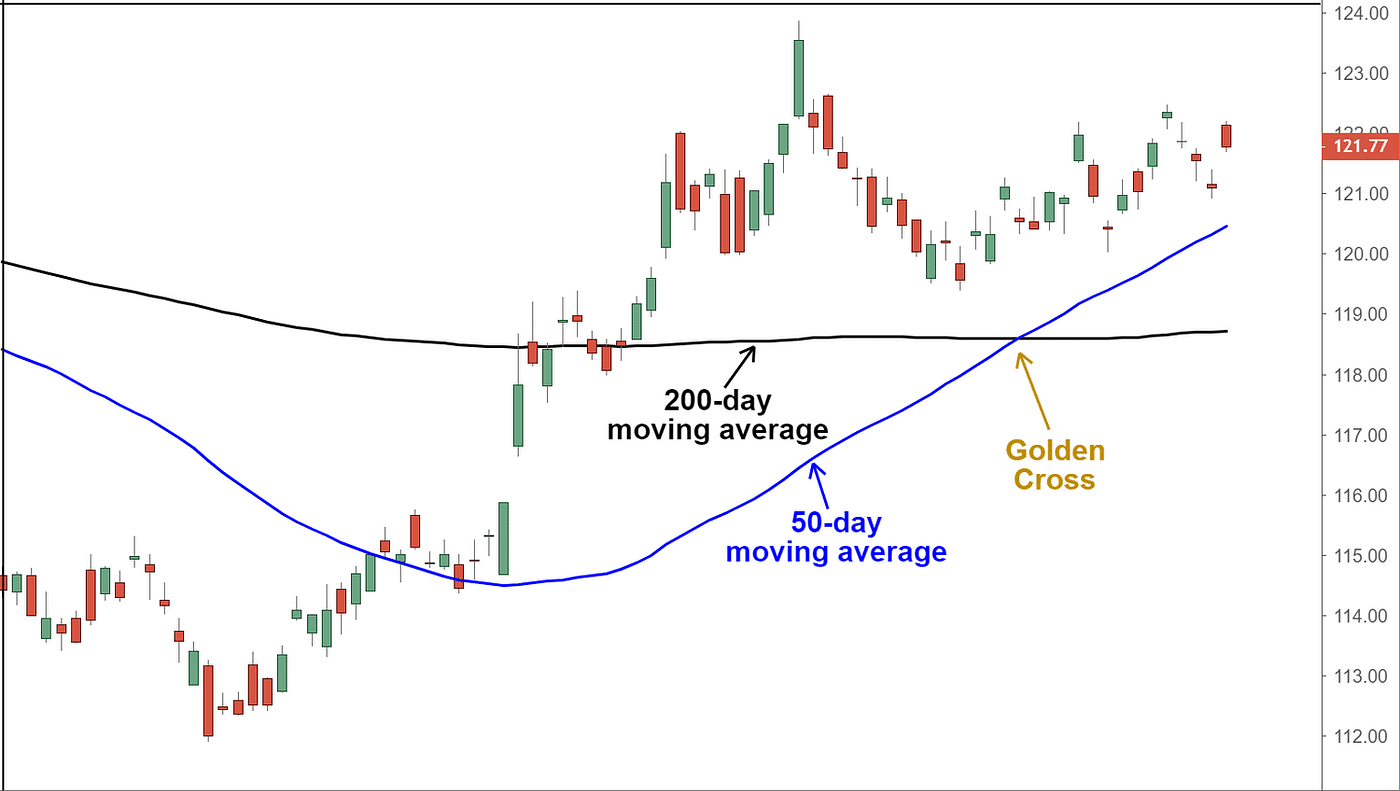

Some strategies are only effective if the asset moves in the predicted direction within a certain time window. For instance, trading based on the Golden Cross pattern assumes that the chart will continue to move up.

If the 50 day SMA goes back down below the 200 day SMA, the setup has lost its efficiency and you probably want to close the position.

Stale asset selloff allows you to do just that.

Stop Loss and Take Profit Decay

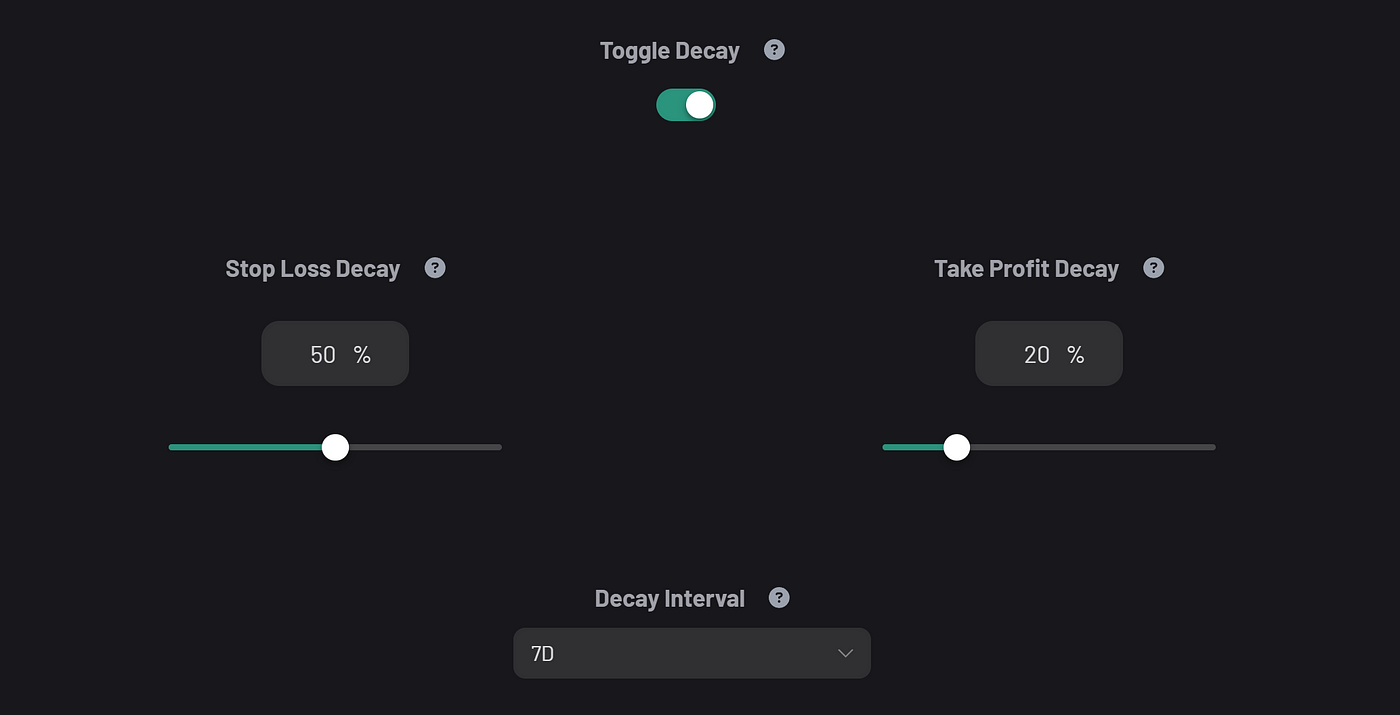

Another way to close down underperforming positions is what we call Stop Loss and Take Profit Decay. This lets you gradually reduce your TP and SL in time, so that it becomes tighter, and thus more likely to close.

For instance, if you’ve set your TP and SL to 20% and you have a Decay of 50% every day, you’ll basically reduce your TP and SL in half every day.

Decay is useful when an asset just isn’t really moving at the rate that you’re expecting so automatically decaying your TP and SL, will help that order to close, and free up liquidity so the bot may place other orders.

I personally found these features to be incredibly useful especially when running multiple bots. Being part of a small and agile team means that I get the opportunity to really connect with users and crypto enthusiasts in general. It also means that we often have long conversations with out users running through any feedback they have and figuring out how to improve Aesir.

That’s all I have for today. If you want to take Aesir for a spin, just sign up at https://app.aesircrypto.com and Join the discord to talk algotrading.

Sign up to Aesir | Join the Discord

Thank you for reading!

Enjoyed this article?

Sign up to the newsletter

You’ll receive more guides, articles and tools via e-mail. All free of course. But if you value this blog and its educational resources, you can subscribe to become a paid member for only $3 a month. This will keep the website open and free.

The post How I improved my crypto trading bot’s exit strategy appeared first on cryptomaton.