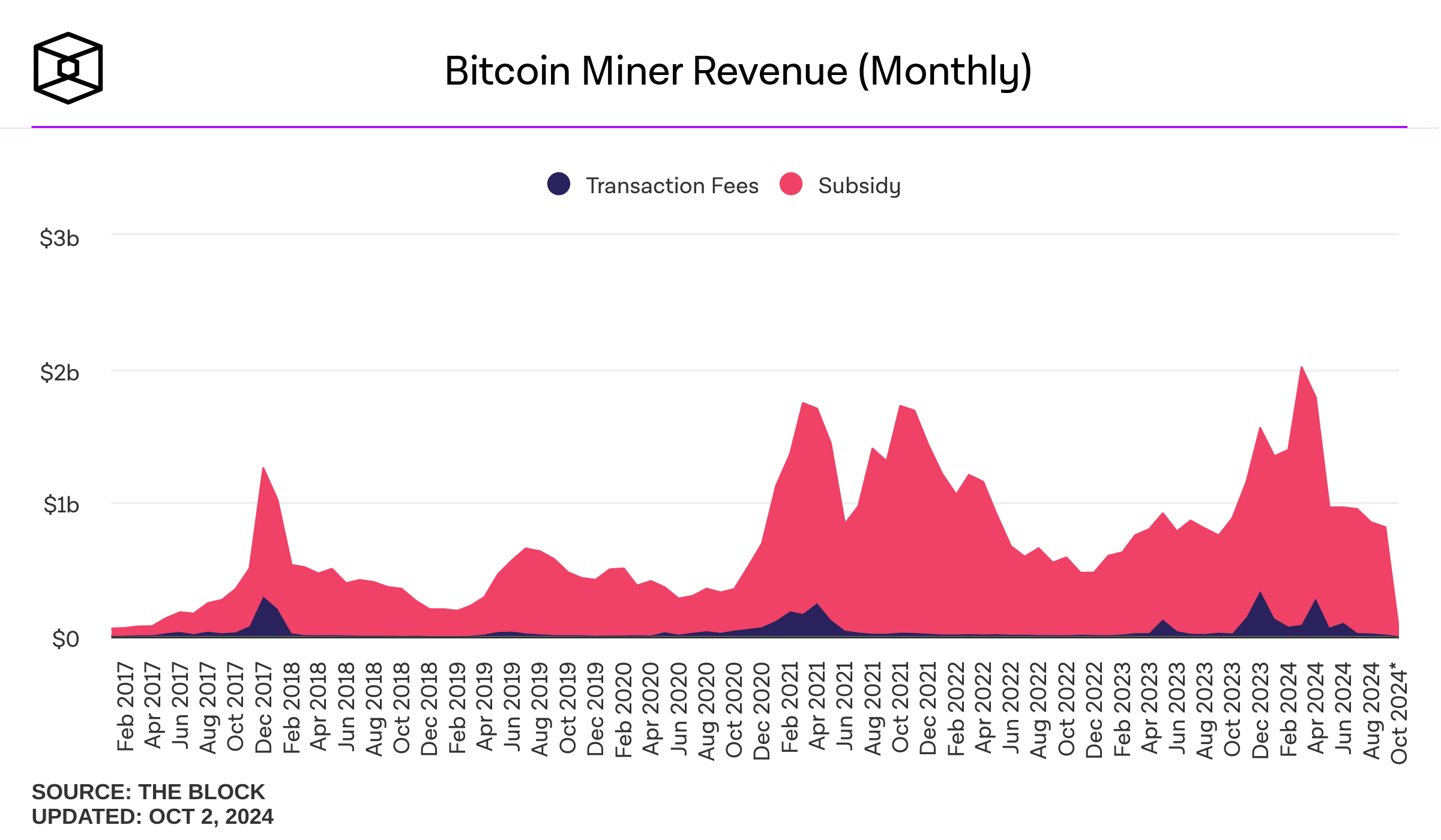

Bitcoin Mining Revenue Hits Yearly Low as Fees Decline in September

- Bitcoin miners faced a challenging September, earning just $816 million due to reduced transaction fees and high operating costs.

- Post-halving challenges, including higher mining difficulty and lower rewards, have strained Bitcoin miners’ profitability.

With a total income of $816 million in September 2024—the lowest number in more than a year—Bitcoin miners had their most difficult month of the year, according to The Block data. This revenue decline emphasizes the growing challenges in the mining industry, particularly in light of the recent halving of Bitcoin.

Usually a major source of money for miners, transaction fees were exceptionally low. Comparatively to other months, the month’s overall fees came out to only $13.86 million. Previously driving a transient increase in transaction fee income, these fee profits were the lowest noted since the launch of BRC-20 tokens in March 2023.

Rising Costs and Halving Challenge Bitcoin Miners’ Profitability

There were several main causes of this revenue decline. The rising cost of mining activities is one of the main difficulties; September alone saw a spike to around $650 million. Reduced benefits from block mining and these high running expenses have put Bitcoin miners in a challenging situation.

Further aggravating the matter was the block reward halving of Bitcoin earlier in the year. Even with the rise in the network hashrate by 2%, the halving event reduces the payout for effectively mining a block from 6.25 BTC to 3.125 BTC, therefore making it more difficult for miners to become profitable.

Furthermore, predicted to rise, Bitcoin’s network mining challenge reaches an all-time high of 88.4 trillion, thereby aggravating the issue. The rising difficulty and diminishing block rewards force miners to keep investing in more sophisticated equipment to keep efficiency and profitability.

For individuals engaged in Bitcoin mining, the profitability margins have been closing despite technological developments and increasing hashrate, therefore posing an uphill struggle.

On the other hand, CNF previously highlighted another milestone is the launch of Hut 8’s GPU-as-a-service platform, a big participant in the bitcoin mining sector, which marks notable advancements.

Having deployed a cluster of 1,000 NVIDIA H100 GPUs at a Tier 3 data center in Chicago, this service is currently completely operational. The action diversifies Hut 8’s economic strategy and lessens its reliance on just earnings from mining Bitcoin.

Beside that, as we previously reported, one of the top mining pools, Binance Pool, has also extended its products by letting members earn Dogecoin and Bellscoin in addition to the current Litecoin earnings via merged mining.

Meanwhile, as of writing, BTC is trading about $60,935.19, down 4,18% over the last 24 hours and 4.25% over the last 7 days.