Bitcoin ETFs See Massive $494M Inflow, Biggest Spike Since June!

- Bitcoin spot ETFs hit a $494 million net inflow, marking the largest since June 4.

- Ark Invest and 21Shares’ ETF ARKB led with $203 million in a $494 million surge.

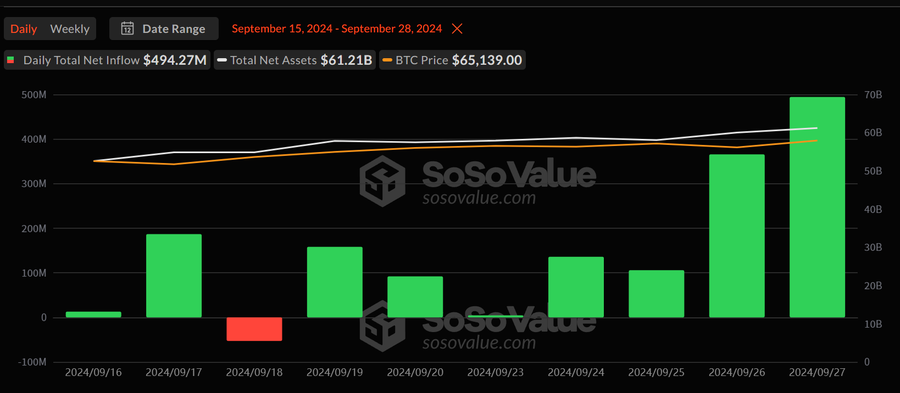

According to Sosovalue, Bitcoin spot ETFs saw a strong increase in activity on September 27, with a net inflow of $494 million, the highest since June 4. This jump increased weekly inflows to more than $1.1 billion, the biggest level since mid-July.

This influx demonstrates growing institutional interest in Bitcoin, indicating that despite recent market volatility, confidence in Bitcoin remains high. The Ark Invest and 21Shares’ ETF ARKB led the inflow with a whopping $203 million, increasing the overall net inflow to $2.723 billion.

Fidelity’s ETF FBTC also had a significant influence, receiving an inflow of $124 million, bringing its total net inflow to $9.986 billion.

Other ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT), contributed to the momentum, culminating in a total net asset value of $61.21 billion for all Bitcoin spot ETFs. This sum now accounts for approximately 4.71% of Bitcoin’s market cap.

Market Shifts as Bitcoin Open Interest Drops Despite Liquidity Surge

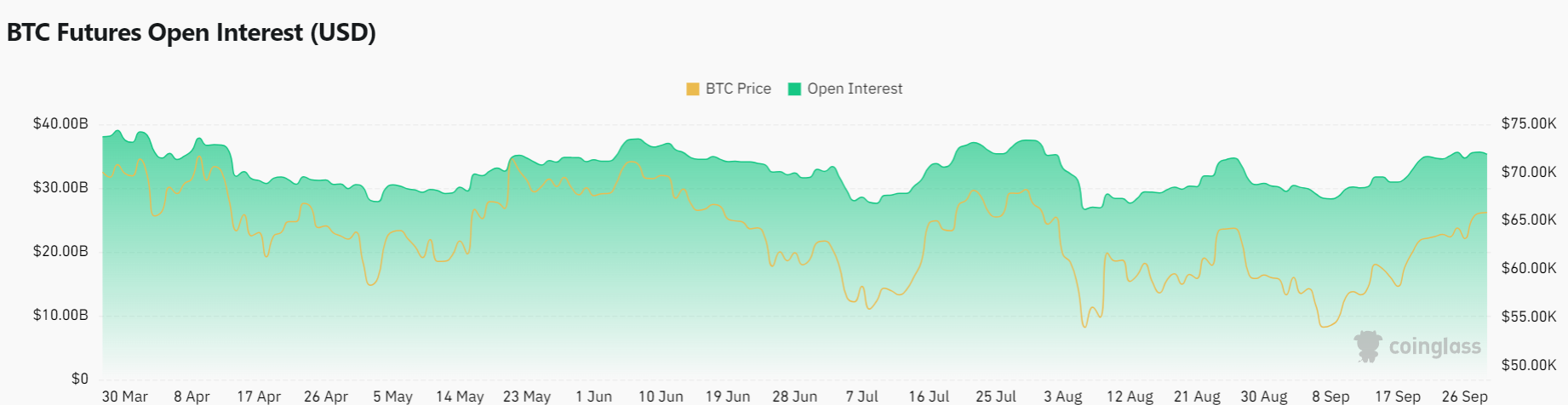

While these numbers show a strong interest in Bitcoin spot ETFs, other market indicators paint a different picture. According to CoinGlass data, Bitcoin’s Open Interest (OI) has decreased by 1.34%, to $35.12 billion.

This decrease followed a period of significant upward movement during the previous few days. A drop in OI could imply that short-term traders are closing positions, pointing to a possible consolidation phase for the coin.

However, it is important to note that this does not necessarily indicate a gloomy mindset, but rather that some investors are taking profits or modifying their strategy following recent advances.

Beside that, as we previously highlighted, Bitcoin’s progress is bolstered by surging global liquidity, which increased by $1.426 trillion this week. This increase in liquidity has propelled Bitcoin’s climb while also positively impacting other risk assets.

According to a well-known on-chain analyst, this injection of liquidity is projected to further enhance Bitcoin and other risky assets as October approaches. Historically, October has been a healthy month for Bitcoin, which may indicate that we will see more bullish movements in the coming weeks.

BlackRock’s recent decision to increase its Bitcoin holdings by 1,413 BTC has fueled the positive sentiment. This action solidifies BlackRock’s position as a major player in the Bitcoin investing area, demonstrating their continued trust in the crypto market.

The company’s continuing accumulation of Bitcoin demonstrates institutional investors’ increasing acceptance of digital assets, implying that the narrative surrounding Bitcoin as a store of value and investment asset is gaining traction.

Meanwhile, Bitcoin is currently trading at $65,539.63, having moved sideways over the last 24 hours.