Bitcoin, ETFs, and Market Trends: Is October the Turning Point?

It’s been a tough year for crypto investors, with hopes rising back in March only to be dashed through the summer. But the question remains—could October finally be the turning point for Bitcoin and the broader crypto market?

In this article, we’ll explore the current state of Bitcoin, the impact of ETFs, and whether we might be gearing up for a big market shift as we head toward the end of the year. Plus, we’ll dig into some charts that could offer a glimpse of what’s to come.

The State of the Market: A Rough Year for Crypto

First off, let’s address the elephant in the room: it’s been a rough time for crypto holders. While traditional stocks, like those in the S&P 500, are inching closer to all-time highs, crypto assets like Bitcoin and altcoins have been struggling. Despite that, some positive news has emerged, like the fact that Wells Fargo is gearing up to start offering Bitcoin ETFs to its clients in September.

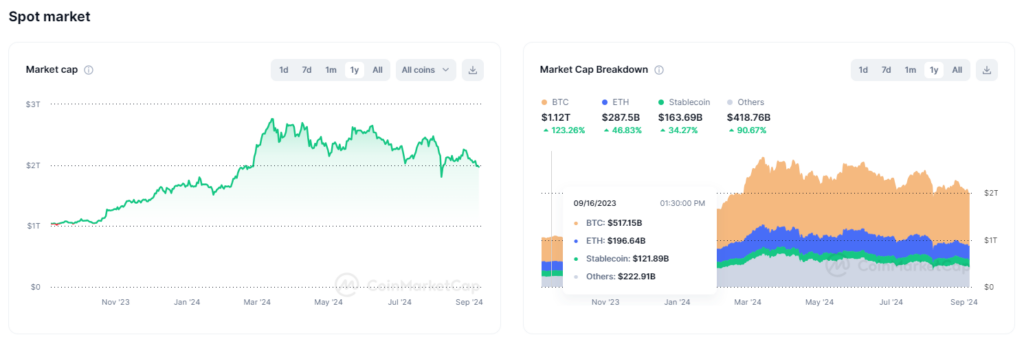

Global Live Cryptocurrency Charts & Market Data

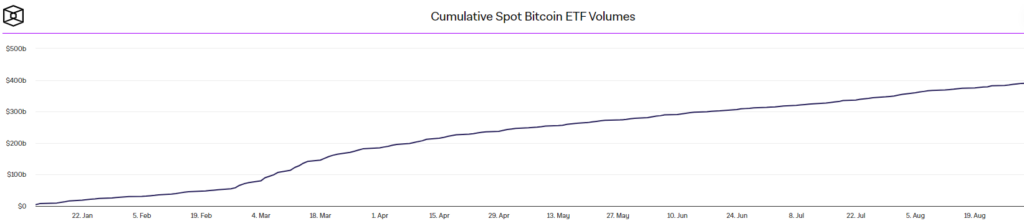

This is a big deal. As we’ve said before, it takes time for all the major financial players to get on board with Bitcoin ETFs, but we’re finally seeing big institutions preparing to pitch these products to their clients. This could bring in a fresh wave of investment capital.

ETF Outflows and Bitcoin Exchange Reserves

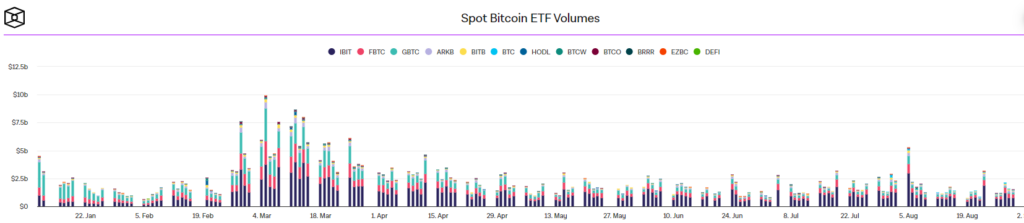

Now, let’s talk about the recent performance of Bitcoin ETFs. Last week, there were some significant outflows, with notable exits from ARK and Fidelity products. In fact, even BlackRock saw its first-ever outflow. While this might sound like bad news, there’s still over $17 billion in net inflows into Bitcoin ETF products, showing that there’s still strong interest overall.

One interesting trend to note is that Bitcoin reserves on exchanges have reached their lowest point this year. Since the COVID crash in 2020, the amount of Bitcoin held on exchanges has been steadily decreasing. While this hasn’t yet translated into higher prices, it’s a sign that investors are moving their Bitcoin into long-term storage, which could be bullish down the line.

Bitcoin’s Struggles to Break Resistance

So, what’s going on with the price? Bitcoin has been hovering just above key support levels, but it’s been a struggle. Right now, we’re seeing Bitcoin maintaining higher lows, but if it dips below $56,000, things could get rough. There are a lot of hurdles to clear, including the 50-day and 100-day moving averages and key resistance at $62,000.

If Bitcoin can break through these levels, we could be in for a rally, but it’s going to be a hard slog to get there. Until then, we might continue to see choppy price action.

A Possible Turning Point in October?

Now, let’s get to the hopium. Some charts suggest that we could be on the verge of a breakout. For example, there’s one chart showing that Bitcoin has historically bounced after hitting oversold levels on the RSI (Relative Strength Index). If this pattern holds, we could see some bullish action in the coming weeks.

Another chart draws parallels between the current market and the period right before the 2017 bull run. Back then, we saw months of sideways action before the market exploded. Could we be in for something similar in Q4 this year? It’s possible, especially with more institutional players getting involved and the Bitcoin ETF narrative gaining traction.

Gold vs. Bitcoin: A Correlation?

Another interesting trend is the correlation between gold and Bitcoin. Gold has been performing well recently, and some analysts suggest that when gold takes a breather, Bitcoin could pick up the slack. Historically, Bitcoin has tended to perform well when gold enters a consolidation phase, so this could be another factor to watch as we head into the fall.

Wrapping It Up: Is October the Turning Point?

While the crypto market has been in a slump, there are plenty of reasons to stay optimistic. The Bitcoin ETF market is growing, even with some short-term outflows, and big players like Wells Fargo are gearing up to bring more investors into the fold. At the same time, the decreasing amount of Bitcoin on exchanges and some bullish chart patterns suggest that a turnaround could be on the horizon.

Will October be the month when things finally turn around? Only time will tell, but all signs point to the potential for a strong Q4, assuming there’s no major macroeconomic shock. For now, it’s all about patience and keeping an eye on key resistance levels. down before and come back stronger, so it’s too early to count it out. But if you’re an ETH holder, it’s understandable if you’re feeling a bit frustrated right now.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Platinum Crypto Trading Floor.

Earnings Disclaimer: The information you’ll find in this article is for educational purpose only. We make no promise or guarantee of income or earnings. You have to do some work, use your best judgement and perform due diligence before using the information in this article. Your success is still up to you. Nothing in this article is intended to be professional, legal, financial and/or accounting advice. Always seek competent advice from professionals in these matters. If you break the city or other local laws, we will not be held liable for any damages you incur.

The post Bitcoin, ETFs, and Market Trends: Is October the Turning Point? appeared first on Platinum Crypto Academy.