Is Bitcoin Ready for $120K? Mastercard, Deutsche Bank, and UK Demand Say Yes

- Bitget has disclosed its plans to meet the rising demand for Bitcoin with the introduction of a crypto-backed payment card.

- Bitget CEO earlier disclosed in an interview with CNF that Bitcoin could finish the year at $126k-$190k.

Bitcoin (BTC) appears poised to surpass its all-time high of $111k after recording a 1.2% gain on its 24-hour price chart, a 0.7% gain on the seven-day chart, and a 3% gain on its 30-day price chart.

Based on current CoinMarketCap data, Bitcoin is strongly holding above the $107k level as demand escalates to a new high. Fascinatingly, this is supported by the 12% surge in trading volume, sending the actual amount to $48 billion.

Bitget Unveils Crypto-Backed Payment Card

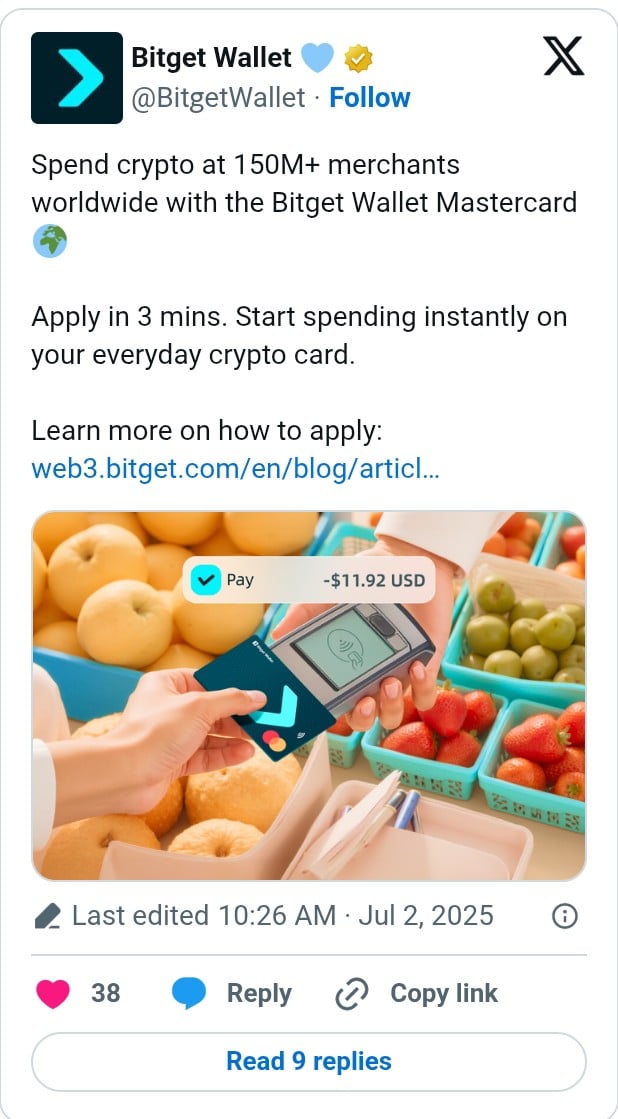

Following the rising demand for Bitcoin, Bitget has announced the launch of a crypto-backed payment card in collaboration with Mastercard and infrastructure provider Immersve. According to the report, this card would be available in the Bitget Wallet app and would facilitate transfers with more than 150 million merchants globally.

Unlike the traditional cards, the Bitget card would have no transaction fees. Above all, it would ensure that real-time funding is enabled via on-chain swaps and deposits. However, purchases would be settled on-chain through the crypto-to-fiat conversion.

The initial target of this initiative is its customers in the UK and the European Union. Later, it would be rolled out to users in Latin America, Australia, and New Zealand.

Commenting on this, the CEO of Immersve, Jerome Faury, disclosed that his firm largely contributed to this by providing the backend infrastructure needed to connect the self-custodial wallet with the payment rail of MasterCard.

Immersve enables real-time, blockchain-native spend from the user’s wallet while ensuring the fiat leg of the transaction is handled securely and in accordance with both Mastercard and regulatory requirements.

For Bitget Wallet CMO Jamie Elkaleh, this Card is meant to meet the demand of users. According to data, 40% of global Bitget wallet users have used crypto for payments. In a recent study we reported on, Bitget Research also disclosed that 20% of its “Gen Z and Alpha” respondents would be ready to get a pension in crypto.

Meanwhile, Barclays recently announced its decision to block crypto transactions via cards, citing issues of a lack of consumer protection and debt risk, as mentioned in our recent news brief.

Research has also confirmed that institutional investors continue to accumulate Bitcoin, with a UK-based web design agency, The Smarter Web Company, adding 230 BTC to its Treasury. Recently, the company raised $62 million and allocated $52 million to buy more of the asset as part of its 10-year Bitcoin reserve strategy.

Making a deeper move into the digital asset ecosystem, Deutsche Bank has also disclosed its plans to launch a full crypto custody service by 2026, as detailed in our recent coverage.

Bitcoin (BTC) to $120k?

Speaking on the potential of Bitcoin price, Bitget CEO Gracy Chen has predicted that Bitcoin (BTC) could finish the year with a price between $126,000 and $190,000.

As indicated in our recent interview, Chen highlighted that Bitcoin could enter its 18th month by the end of this year from the last halving cycle. According to her, the 4th quarter of 2025 could be a bullish period with Bitcoin expected to surge by 2x or 3x from the April 2025 halving price of $63k.

As also highlighted in our earlier analysis, other experts believe that Bitcoin has the potential to hit $200k this cycle.