Crypto Forecast 2025: Coinbase Expects Mid-Year Stability, Q3 Bull Run

- Coinbase warns of short-term volatility due to macro risks and trade tensions but sees stabilization by mid-year.

- Q3 2025 could trigger major crypto gains as halving effects, ETF approvals, and institutional interest converge.

In a market that has been anything but predictable, Coinbase is laying out a forecast for 2025 that urges patience now for bigger rewards later. According to its April 2025 Monthly Outlook, things might get rocky for the next few weeks. The company expects crypto assets to remain under pressure through mid-May, citing rising macroeconomic risks and global trade tensions.

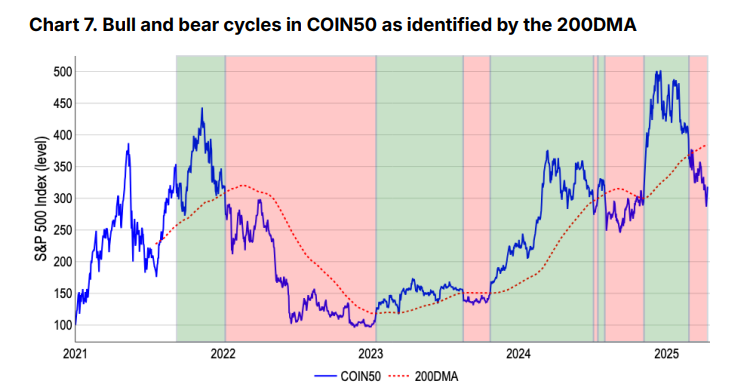

Bitcoin and the broader COIN50 index have both slipped under their 200-day moving average—a technical signal some view as the early stage of a bearish cycle. The COIN50 reflects the 50 biggest and most liquid cryptocurrencies by market value. Coinbase believes this dip might be temporary and part of a bigger reset, especially as investors brace for policy shifts and unpredictable trade moves.

One major factor adding weight to the uncertainty: U.S.-China relations. Recent flare-ups have driven the Chinese yuan to an 18-year low, and the Fear & Greed Index hovered in “Extreme Fear” territory as 2025 kicked off. The tone has become familiar—markets dislike uncertainty, and crypto is no exception. Morningstar’s Q1 2025 review adds fuel to this, noting that interest rate expectations and tighter global policies are unlikely to ease just yet.

Stabilization on the Horizon

Still, Coinbase doesn’t see the gloom lasting much longer. The firm expects prices to settle and find support from May through June. A number of historical trends back this view. In 2020, for example, Bitcoin nosedived from $10,000 to $3,850 in March but found a foothold by May, trading steadily around $6,000 to $7,000. The takeaway from such cycles? Panic fades, and recoveries follow.

QCP Capital, echoing this theme, sees a bullish second quarter forming out of the current chaos. They point to traditional finance signals that hint at renewed strength in risk assets. Likewise, ARK Invest’s “Big Ideas 2025” calls this year a potential breakout moment, citing expanding institutional interest and fresh blockchain tech as key drivers. “Unprecedented growth” is the phrase used in their outlook.

And those aren’t empty predictions. Institutional money is already flowing in. Coinbase’s broader 2025 market outlook reveals growing demand from big players, helped by the approval of spot Bitcoin ETFs. More institutional access means deeper liquidity, stronger fundamentals, and—potentially—less wild price swings.

Q3 Could Light the Fuse

If all goes as Coinbase anticipates, Q3 2025 is when things really take off. This period falls right in line with Bitcoin’s post-halving cycle—a pattern that’s historically delivered big gains. The halving occurred earlier this year, slashing the rate of new Bitcoin issuance, which often tightens supply just as demand picks up.

Also in the pipeline are new crypto ETF approvals and potentially cleaner regulations. These developments, expected to unfold over the next few months, could add significant momentum to the bullish setup Coinbase is eyeing. ARK Invest backs this view, stressing that better regulatory clarity and maturing blockchain infrastructure will be key to long-term sustainability.

Tight fiscal policies may be stifling now, but there’s growing belief that central banks could shift stance by early summer. Morningstar hints at looser monetary policies and softening bond yields in Q2, both of which would be a green light for higher-risk assets like crypto.