Crypto Faces Ripple Effects From Record US Debt in 2025

- Record U.S. Treasury supply in 2025 could pressure rates and impact crypto markets through shifting institutional sentiment.

- If debt monetization occurs, crypto may gain traction as a hedge against fiscal instability and weakening confidence in fiat.

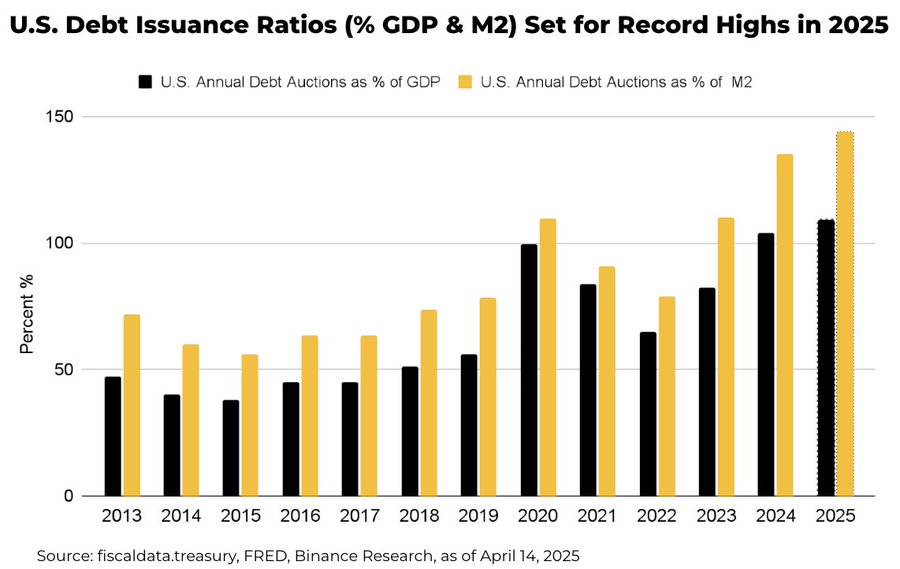

The US government bond market is expected to face an unusual challenge throughout 2025. The US government is projected to auction debt worth more than $31 trillion, including for refinancing purposes. This is not just high—it is extraordinary. Imagine if household spending suddenly swelled to more than double annual income. That is roughly the pressure the market will face.

Global Demand Faces a Tipping Point in 2025

The $31 trillion figure, by comparison, is equivalent to about 109% of the total US GDP projected for that year. Even when compared to the money supply in circulation (M2), the value reaches 144%. In normal circumstances, the market would look for gaps through foreign demand.

But the problem is, about a third of US government debt is currently held by foreign investors. Well, if they start to reduce exposure—whether due to geopolitical conflict or simply rebalancing their portfolios—interest rates could spike as borrowing costs automatically increase.

Furthermore, even though there are no signs of extreme decline in foreign demand, the scale of debt issuance is still a heavy burden. Occasional positive sentiment, for example, due to optimism around trade negotiations, still cannot reduce the pressure on the debt market.

Moreover, in the long term, dependence on debt auctions could have a domino effect on various sectors, including the digital asset market.

Adam Posen of the Peterson Institute adds another layer of concern. According to him, the US economy is on the verge of a recession with a possibility of reaching 65%. In fact, he warned of the potential to enter a phase of stagflation – a combination of high inflation and slow economic growth.

In his view, the Fed’s loose policy and the effects of tariffs imposed during the Trump era are the two culprits. He is worried that if the Fed does not respond with a more decisive adjustment of interest rates, the potential for chaos could be even greater. Not to mention, if the government tries to stimulate the economy through additional fiscal stimulus without careful calculation.

Crypto Braces for Shockwaves From Debt Monetization

On the other hand, the crypto market has also absorbed the impact. This week’s inflows into Bitcoin ETFs reflect the ongoing volatility. On April 16, the largest outflows were recorded at $171.1 million. Fidelity contributed $113.8 million, and Ark disbursed $113.2 million.

But interestingly, the market reversed direction the next day with inflows reaching $106.9 million. This means that even though Bitcoin’s price remains around $84,000, institutional dynamics remain active and full of surprises.

However, there is one narrative that is getting stronger behind the scenes. If the US government runs out of options and starts printing money to cover the deficit (aka debt monetization), then Bitcoin could steal the spotlight again as a hedge.

In a scenario like this, not only retail investors will start looking at digital assets, but also large institutions that have been conservative.

Finally, there is one political maneuver that could influence the direction of future monetary policy. CNF highlights Donald Trump who is reportedly considering legal action to remove Jerome Powell from the Fed Chair.

He claims that Powell is too slow and often makes mistakes in maintaining economic momentum. If this plan really goes ahead, it is not impossible that we will see new turmoil that will mix up market dynamics—from interest rates, inflation, to the dollar exchange rate.