VanEck Reveals China and Russia Are Settling Energy Deals in Bitcoin

- A recent report by VanEck has disclosed that China and Russia are settling energy trade with Bitcoin and other cryptos.

- Multiple countries have also been reported to explore ways to bypass the US Dollar in their importations.

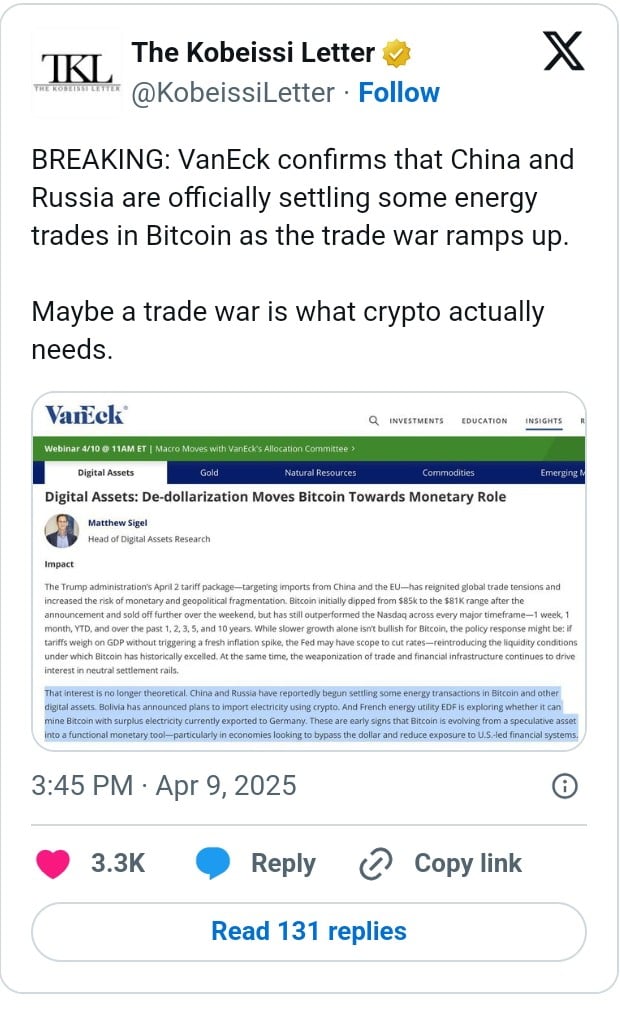

Investment management firm VanEck has confirmed that China and Russia have advanced efforts to practicalize their Bitcoin interest in an ongoing trade involving energy. According to the report authored by head of research Matthew Sigel, this decision was influenced by the April 2 reciprocal tariffs imposed by the US on China, the EU, and other countries.

The Details of the Story

VanEck’s report comes after Reuter highlighted last month that China and Russia are using cryptos in their oil trade to evade US sanctions. According to them, tens of millions of dollars are spent monthly in this trade.

Explaining how it is done, the outlet stated that Chinese buyers of Russian oil make payments in Yuan to a trading company that acts as a middleman. The middleman then converts the money into Bitcoin, Ether, USDT or any other stablecoin and transfers it to another account. From there, the cryptos are sent to another third-party account in Russia, which is then converted to Rubles.

Meanwhile, Sigel believes that the interest of Bitcoin in international trade is also being considered by several other countries. According to him, Bolivia is set to import electricity using crypto. Similarly, the French energy utility (EDF) is exploring ways to channel its surplus electricity into Bitcoin mining.

As indicated in our previous publication, Bitcoin currently exists as a better substitute for economies seeking to bypass the dollar like the BRICS, pushing it from a mere speculative asset to a crucial monetary tool.

Impact of the US and China Tariff War on Bitcoin

As highlighted in our previous article, the US recently imposed high percentages of tariffs on several countries, forcing the Bitcoin price to decline from $84k to $74k. However, the urgent response by global leaders and experts informed the decision of US President Donald Trump to suddenly announce a 90-day pause in all reciprocal tariffs except China.

Reacting to this, Bitcoin surged by 6% in its 24-hour time frame, moving from its daily low of $75k to $83k before declining to $82k. Currently, its daily trading volume has surged by 38% as $76 billion changes hands.

According to VanEck, Bitcoin is still holding strong in the face of these monetary and geopolitical fragmentation risks. Sigel believes that Bitcoin has outperformed most US stocks, including NASDAQ, across every major timeframe.

In the report, the research head urged investors to closely monitor changes in the Federal Reserve policies to make decisions as “a shift in rate expectation and increasing liquidity are historically positive for Bitcoin.”

If tariffs weigh on GDP without triggering a fresh inflation spike, the Fed may have scope to cut rate – reintroducing the liquidity conditions under which Bitcoin has historically excelled.

Meanwhile, other analysts have explained that a trade war might actually be good news for Bitcoin, as noted in our earlier post.